Tujuan dari panduan ini adalah untuk membantu klien kami di Malaysia memahami cara kerja fitur SST di Vanda.

Untuk memanfaatkan fitur SST, pengguna harus terlebih dahulu mengatur tarif pajak secara akurat di VandaClinic.

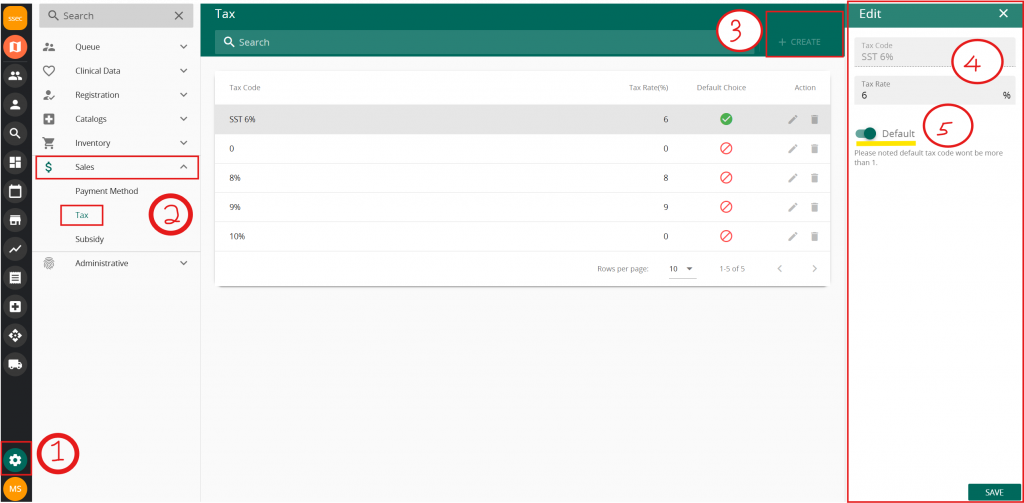

- Klik pengaturan

- Buka penjualan -> Pajak

- Klik “+ Buat”

- Masukkan yang berikut ini:

- Kode pajak: SST 6%

- Tarif pajak: 6

- Pastikan tombol default diatur ke aktif sebelum menyimpan.

- Jika tarif pajak dinaikkan atau diturunkan di masa mendatang, buatlah seperti berikut. Misalnya, tarif pajak disesuaikan menjadi 7%.

- Kode pajak: SST 7%

- Tarif pajak: 7

- Tetapkan tarif pajak baru sebagai default

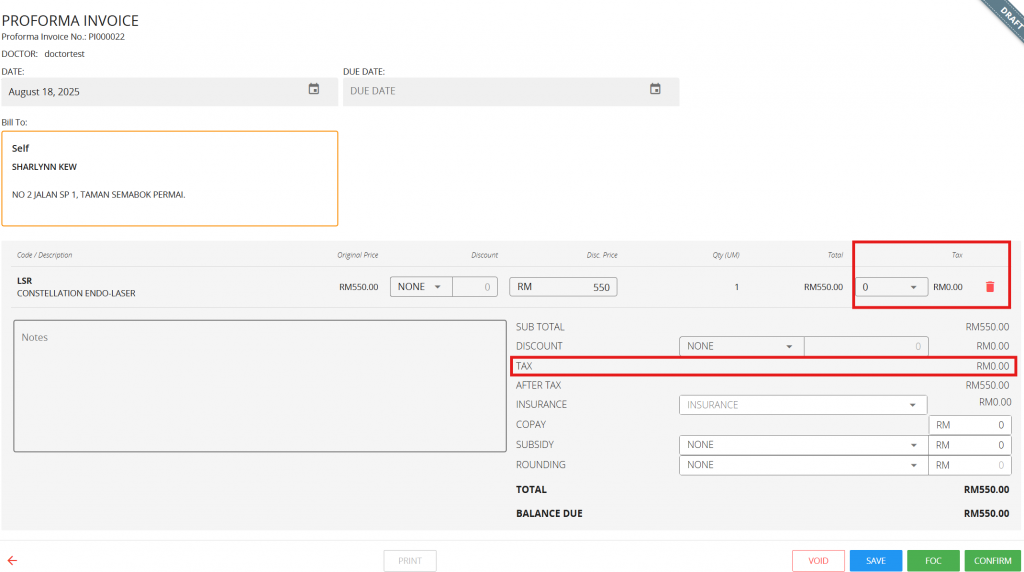

Setelah tarif pajak ditetapkan dan ditetapkan sebagai default, buat penagihan seperti biasa.

Otomatisasi SST bergantung pada 2 faktor:

- Jumlah pajak dibuat dan ditetapkan sebagai default

- Jenis ID Pasien

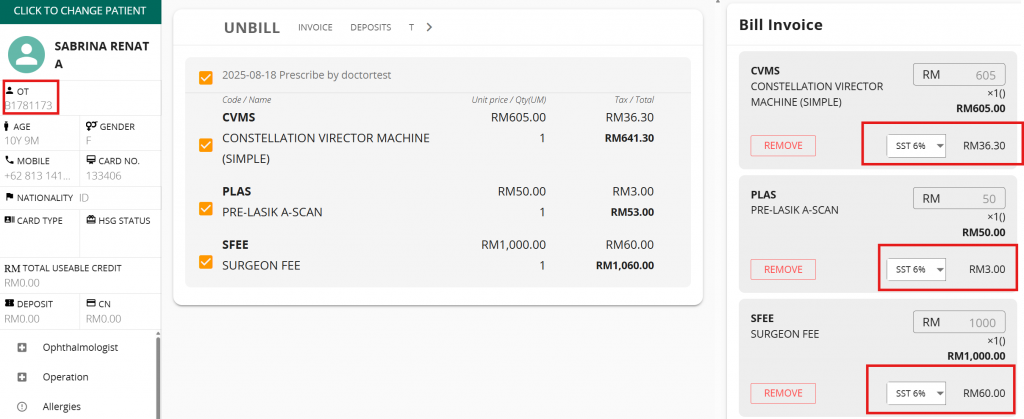

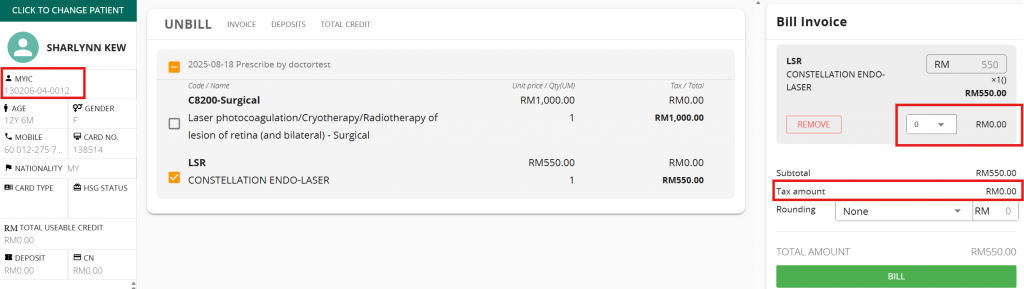

Jika jenis KTP bukan "MYIC", Vanda akan otomatis menetapkan tarif pajak ke 6%. Gambar berikut menunjukkan jenis KTP Non-Malaysia "OT" dan tarif pajak yang ditetapkan Vanda secara otomatis ke 6%.

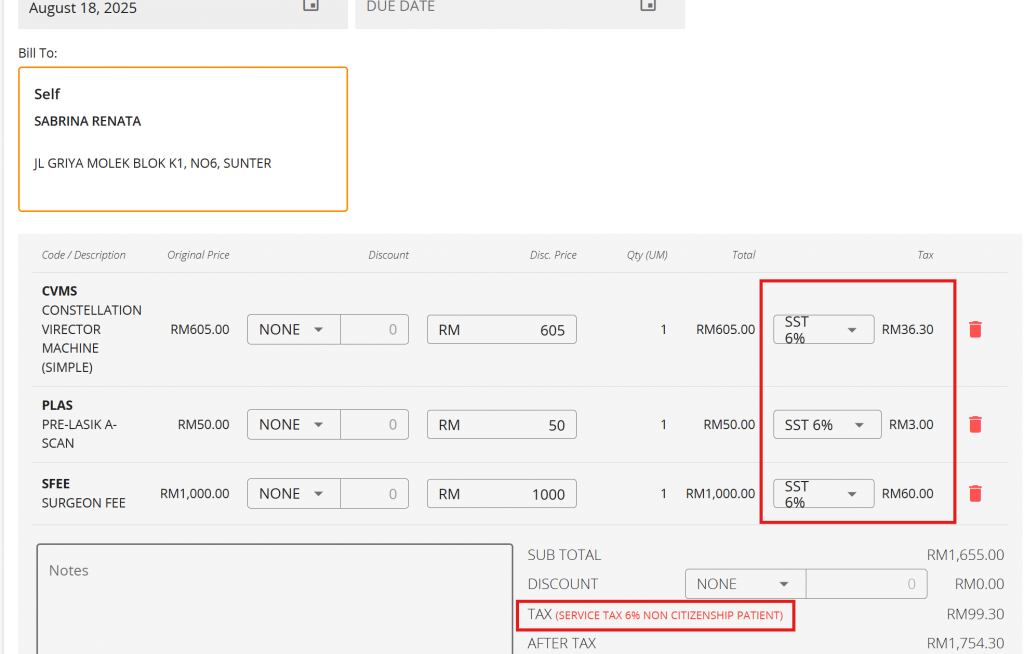

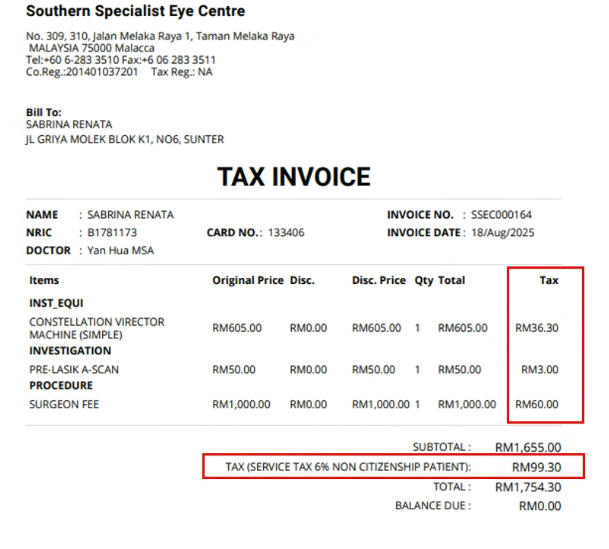

Untuk Jenis ID Non-Malaysia, akan ada indikasi untuk menginformasikan pengguna tentang SST 6% di bagian faktur.

Indikasinya akan ditampilkan pada hasil cetakan juga

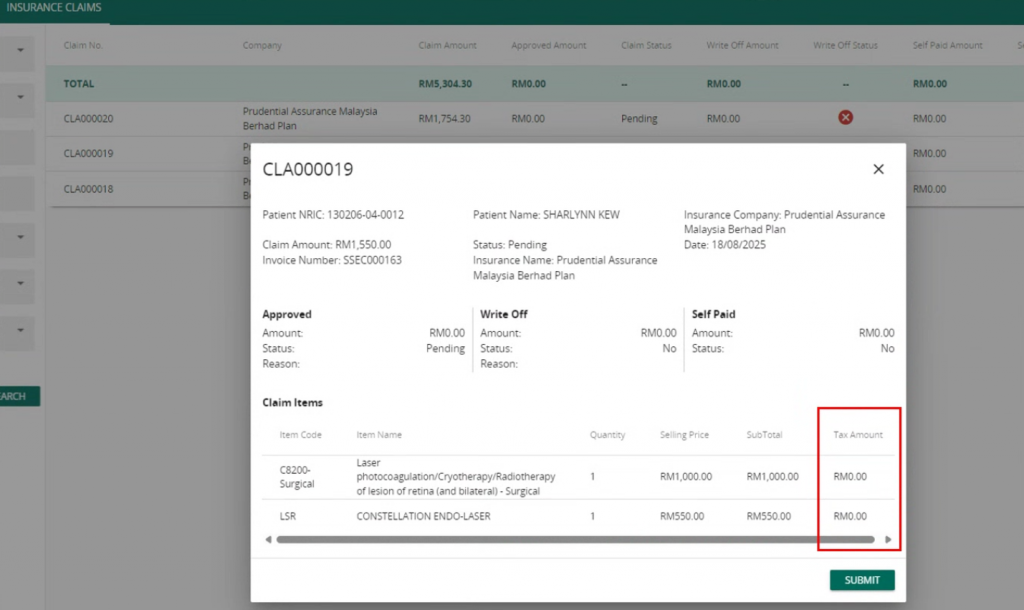

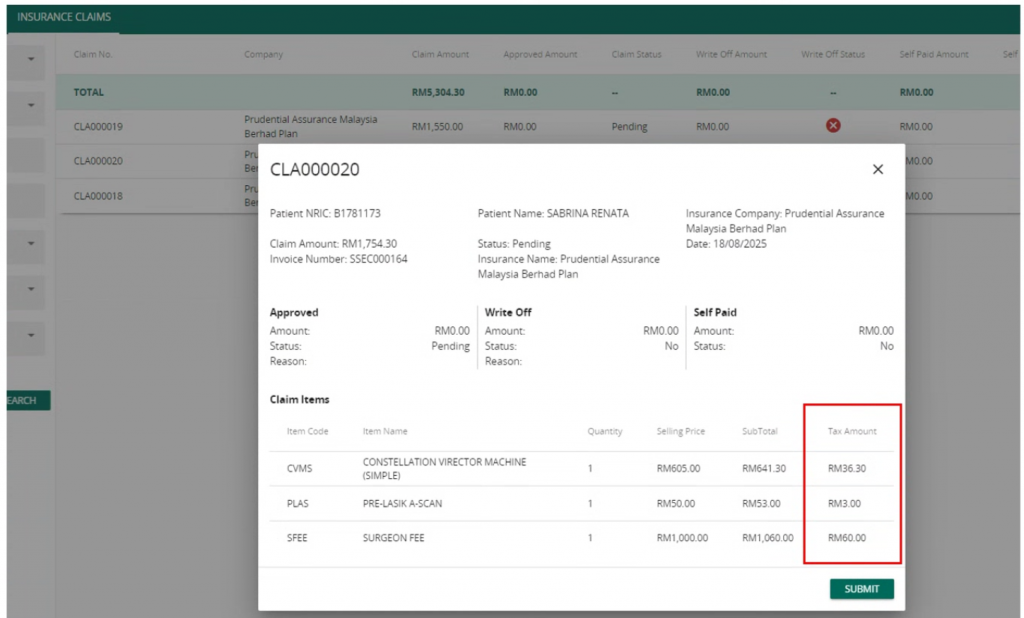

Modul asuransi juga akan mencerminkan jumlah pajak yang sesuai

Tipe ID: MYIC

Tipe ID: Non-Malaysia