本指南的目的是帮助我们在马来西亚的客户了解 Vanda 中的 SST 功能如何运作。

要使用 SST 功能,用户必须首先在 VandaClinic 中准确设置税率。

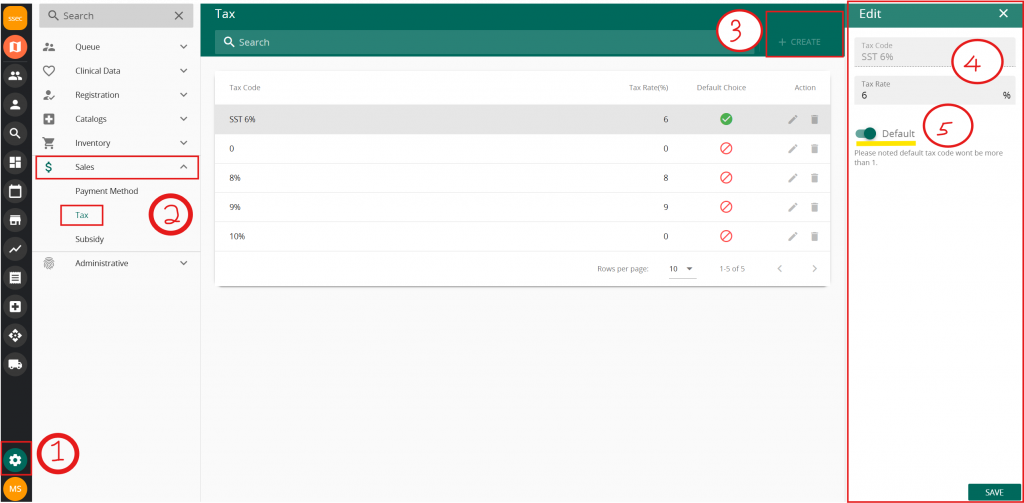

- 点击设置

- 前往销售 -> 税务

- 点击“+创建”

- 输入以下内容:

- 税号:SST 6%

- 税率:6

- 确保在保存之前默认按钮已设置为活动状态。

- 如果未来税率增加或减少,则按以下方式创建。例如,税率调整为 7%

- 税号:SST 7%

- 税率:7

- 将新税率设置为默认税率

一旦设置了税率并将其设置为默认值,即可照常生成账单。

SST 的自动化取决于两个因素:

- 税额已创建并设置为默认值

- 患者的身份证类型

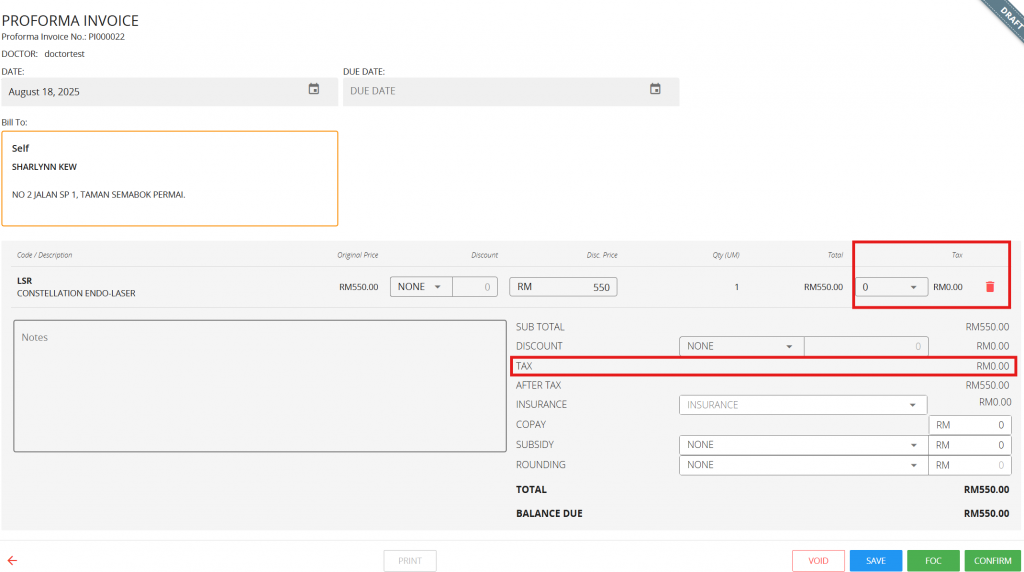

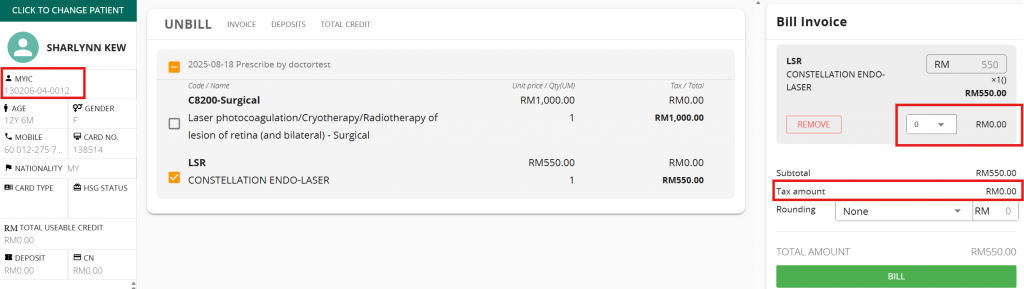

从下图中您可以看到,如果患者的身份证类型为 NRIC/Army,代码为“MYIC”,则账单和发票部分的税额将自动设置为 0%。

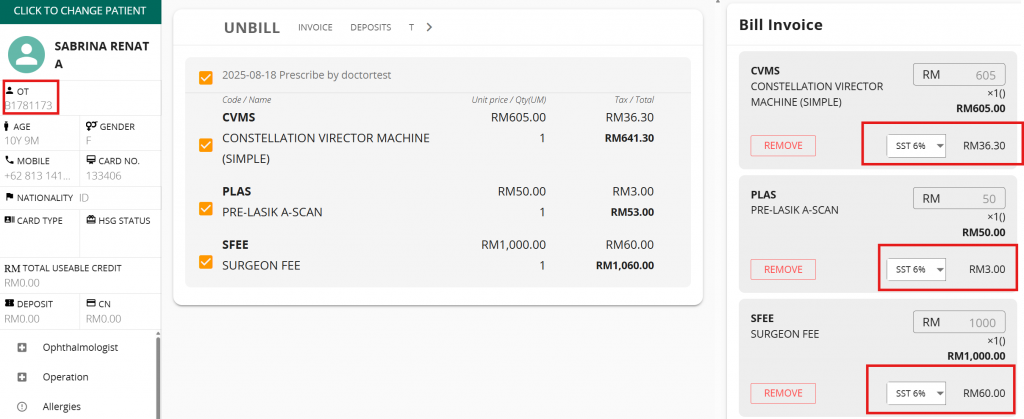

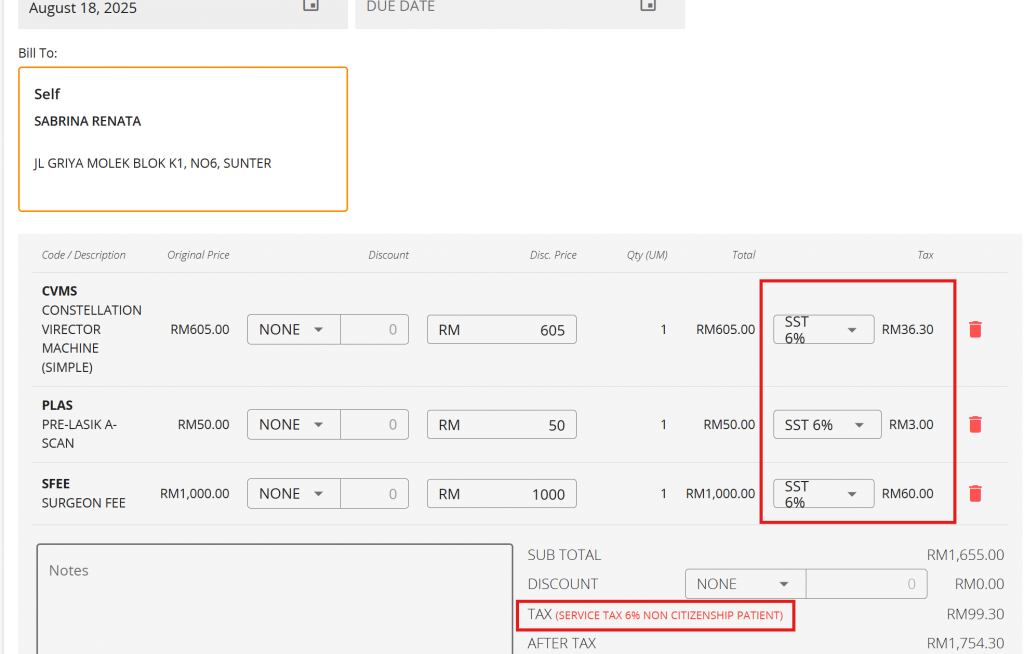

如果身份证件类型不是“MYIC”,Vanda 将自动将税率设置为 6%。下图展示了非马来西亚身份证件类型“OT”,Vanda 自动将税率设置为 6%。

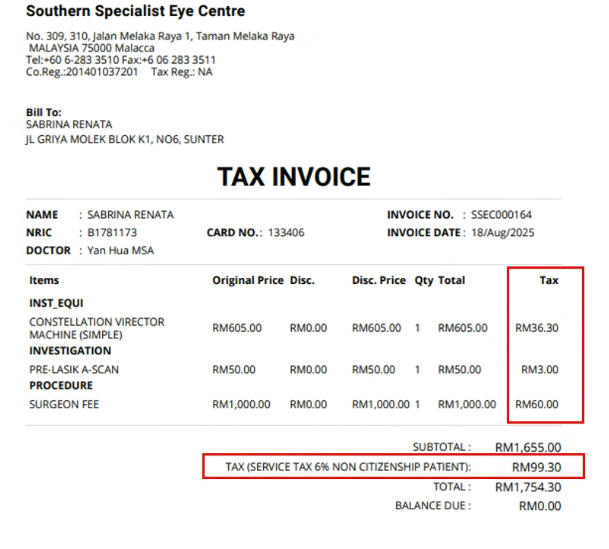

对于非马来西亚身份证类型,发票部分将会有提示,告知用户 6% SST。

该指示也将显示在打印输出中

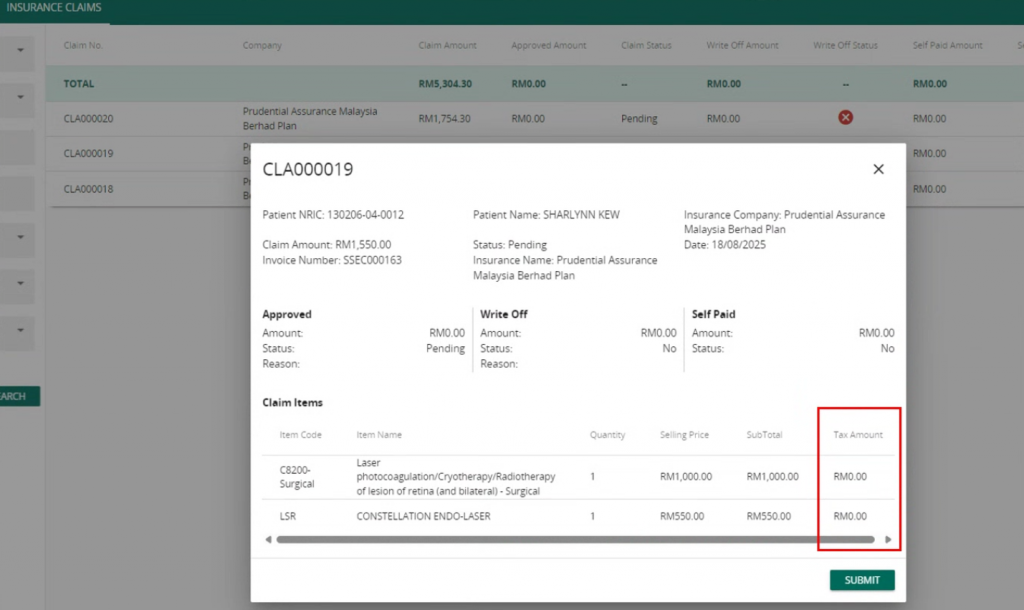

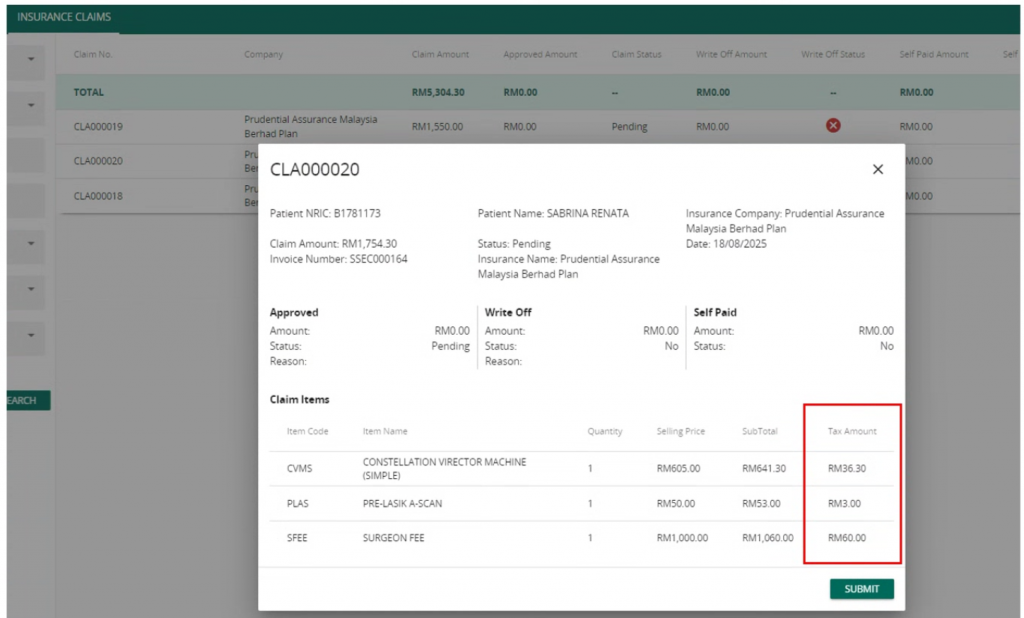

保险模块也会相应反映税额

身份证件类型:MYIC

身份证件类型:非马来西亚公民